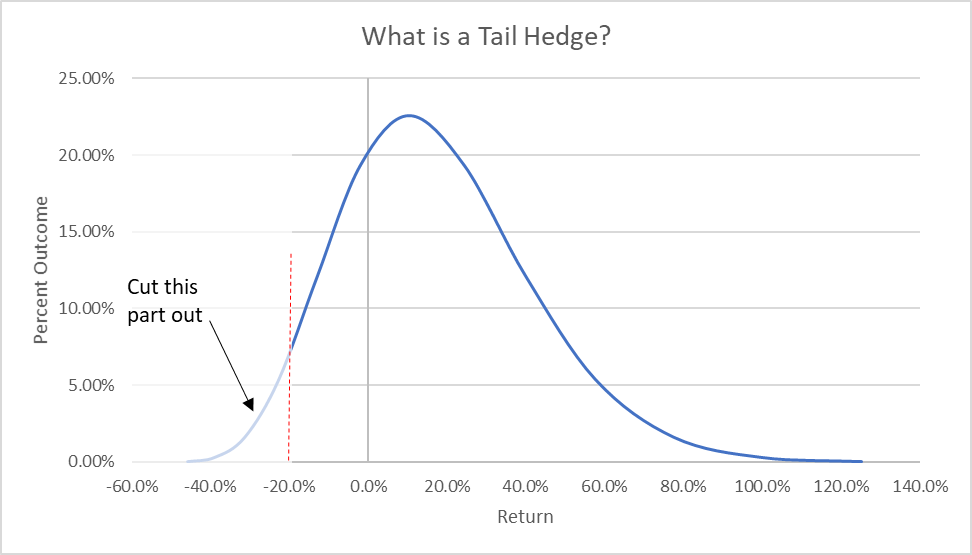

Thus we can clearly see why this is called left tail risk. The distribution shows many more losers on the left side than on the right side (from 10%). If we contain the losers, the winners tend to take care of themselves.īelow is a distribution that has a “fat” left tail risk and “thin” right side profits: As traders and investors, we are more concerned with the losers than the winners. Why the left side? Because the left side contains the losses, while the right side has the winners.

Negative skewness is also called left fat tail. This is why you need to understand if your strategy has a positive or negative skew. Thus, one loss can wipe you out and even bring down years of profits. You can be successful at this strategy for a long time, even many years, until a freak event makes a stock soar multiple times. Even worse, there are theoretically no limits on the losses. This is a strategy that has many small winners, but unfortunately a few big losers. Let’s assume you are writing deep out-of-the-money calls (not covered calls). Opposite, when the distribution is negatively skewed, both the mean and the median is less than the top (the mode).ĭoes negative and positive skewness relate to trading? Yes, because negative skewness has the potential of ruining you. When a distribution is positively skewed, it means that both the median and the mean are greater than the top of the distribution curve (the mode). The difference between a negative and positive skew can be illustrated like this: We have previously written an article that covers negatively skewed trading strategies. Watch the trader who makes consistent money. Negatively skewed vs positively skewed distributions

Opposite, right tail risk (right fat tails), are unexpected positive outcomes. Hence, it’s frequently referred to as left tail risk. If we look at a probability distribution, the unwanted tail risk is normally on the left side of the distribution curve and happens more frequently than a normal distribution suggests. Hence, tail risk is something that is rare and seldom and “hidden” in the corners (the tails).

PARALLAX VOLATILITY ADVISERS TAIL HEDGING SKIN

This is what Taleb writes in Skin In The Game” about tail risk:įor, as with financial traders, the best place to hide risks is “in the corners”, in burying vulnerabilities to rare events that only the architect (or the trader) can detect – the idea being to be far away in time and place when blowups happen. But statistical studies of financial markets indicate “freak events” have fat tails. Any Monte Carlo simulations of sets of coin tosses are less likely to deviate from the long-term mean of a 50% chance for head or tail. Why? Nassim Nicholas Taleb, the author of The Black Swan and seen as the mastermind behind the philosophy of tail risk, argues that random huge movements in the financial markets happen more frequently than the normal distribution indicates.įor example, 1000 coin tosses are a perfect example of a normal distribution. We can argue that fat tails are a more realistic outcome of an event. But the fat tail distribution might indicate otherwise and subsequently, the trader underestimates the risk he is taking. If a trader or investor uses the blue line as the expected outcome, he might be filled into believing the risk is much lower than it actually is. In order to better understand the concept we made a chart to explain the difference between a normal distribution (bell curve) and a fat tail distribution: Tail risk is often referred to as “ fat tails“. What is tail risk? What is a fat tail? What is tail distribution? Tail risk strategies are difficult because we are risk-averse.Our own experience of tail risk hedging strategies.How has Cambria’s Tail Risk ETF performed during a crisis? Does tail risk hedging work?.Hedging tail risk strategy example: Cambria’s TAIL ETF (backtest).Trend following as tail risk hedge strategy.Ray Dalio’s All Weather Portfolio (All Weather Principles).Tail risk ETF (ticker: TAIL): Meb Faber and Cambria’s tail risk ETF.Put options as a hedge against tail risk.Tail hedging strategies: How do you hedge against tail risk?.Hedge against tail risk to avoid behavioral mistakes.Why do you want to hedge against tail risk?.Negatively skewed vs positively skewed distributions.What is tail risk? What is a fat tail? What is tail distribution?.

0 kommentar(er)

0 kommentar(er)